The dollar market is unstable, uncomfortable

The dollar market is unstable, uncomfortable

Banks are charging importers Rs ninety-two-93 in keeping with the dollar. Due to this, the price of imported goods is growing.

Bangladesh is devaluing the greenback in opposition to the greenback by keeping family members in other international locations. The price of our dollar is rising. Bangladesh bank is constantly promoting greenbacks from the foreign exchange reserves to fulfill the import obligation. In the last one and a half months, the dollar has risen with the aid of 70 paise in a few steps. Ultimate Monday, which accelerated to 7 rupees 80 paise.

However, banks are charging importers Rs ninety-two-ninety-three in step with the dollar. Because of this, the fee for imported goods is growing. Which is affecting the prices of customer items. Purchasers have to buy products at better costs.

To discourage imports, Bangladesh bank has multiplied the cash deposit fee even as commencing bonds. This is due to the fact the reserves that us of a has can’t be used to pay for the following six months.

Meanwhile, despite the fact that there’s no courting with the banking channel, the cash dollar market has come to be greater volatile. The day before today, the rate of coins consistent with the dollar passed ninety-three rupees. After Corona, going abroad has improved, resulting in multiplied demand. However, foreign travelers and cash dollars are coming to the USA much less. That is why costs are rising.

Humans inside the quarter say that the greenback is rising within the banking channel due to the boom in imports. For this, big projects have to be taken to boom export and expatriate income. And in order to overcome the crisis inside the open market, it’s miles vital to bolster the supervision in order that no one can take more than the limit of cash bucks abroad.

The price of imports has expanded by approximately forty six-cent due to an increase in commodity expenses and freight in the international marketplace (July-March). However, the export income has improved by way of 33 percent. Again, the expatriate earnings is 17 percent much less than last year. That is observed via the compensation of big foreign loans of the general public-non-public sector. As an end result, approximately ২০০ two hundred million more is being spent every month than profits. Due to this the charge is increasing.

In keeping with Bangladesh financial institutions, the rate consistent with the greenback on the banking channel changed into Tk eight on March 22. After that, the price turned extended in numerous degrees. And remaining Monday it was expanded to six rupees 60 paise. But, banks are charging importers Rs ninety-two-ninety-three in step with the greenback. A few humans have additionally said that they have got taken 95 rupees. But, it isn’t always referred to in the prices introduced via the banks. Yesterday, the rate of dollar introduced via the importers of Agrani and eastern financial institutions changed to eight rupees seventy-five paise.

Mahbubul Alam, president of Chittagong Chamber and chairman of M Alam institution, instructed Prothom Alo: meanwhile, the bank has to pay 95 rupees for every dollar. The difference in the value of the dollar has turned out to be 7 rupees, which has in no way taken place earlier than. Now the charge of the product isn’t going to grow according to the price. The condition is like a blow to the head. For that reason, many humans remember the enterprise of importing goods as a risk. ‘He demanded that the fee of dollar need to be constant for the import of vital items.

In the banking region in addition to in the open market and money changer, the charge of cash greenback is now high, which has handed Rs ninety-three. Even earlier than Eid which changed into ninety-one rupees. Concerned people say that there may be no supervision over the open market. Many are collecting large sums of money. The stress to go overseas has multiplied again. That quantity of bucks is not coming from overseas. Because of the disaster. The only source of coins dollars is to bring alongside from overseas.

In 2016, Bangladesh bank allowed trendy Chartered financial institution to import ৫০ five million really worth of overseas forex in response to the cash dollar crisis. But, the bank did not import the currency due to the imposition of about 36 percent tax and responsibility on greenback imports. Preferred Chartered bank closing imported লাখ 4 million worth of foreign exchange in 2011.

As the cost of the greenback rises, so does the value of those going abroad. Motijheel dollar trader said. “a number of human beings are going abroad now,” Ripon said. But, the delivery of dollars is low. This is why expenses are rising. ‘

Pull in reserve

Bangladesh bank is constantly selling bucks from the reserve to overcome the crisis. That is reducing the reserves. It sold 21 million greenbacks on Wednesday. Inside the modern-day financial yr, the quantity of dollar income has handed 500 crores. Reserves had been decreased by means of হাজার four.195 billion because of the Asian Clearing Union (ACU) bill price and dollar sales for imports. Final December it changed into four, six hundred crore greenbacks.

In the meantime, the banks have deposited around Tk forty,000 crores in Bangladesh financial institutions to buy dollars inside the modern-day economic 12 months. Because of this, the extra liquidity within the banks has also come down. Extra liquidity has decreased by using Tk 1 lakh ninety-six thousand crores in March. But, the quantity of actual lazy money is less than 30 thousand crore rupees.

Dhaka bank coping with Director (MD) Emranul Haque instructed Prothom Alo, “Imports have gone up because of the struggle and Ramadan. Apart from this, a fee of the remaining import liability has begun. The greenback price is growing for this. Now we need to boom surveillance on export and expatriate profits. Sports ought to be expanded to stop hundi. Only then will the marketplace turn out to be stable. We’re selling bucks on the charge we are becoming. I am no longer making any profit on this. ‘

Bangladesh bank is putting the fee by means of promoting dollars. However, economists are in favor of leaving the dollar on the market. Because it’s going to increase export and expatriate profits. However, Bangladesh bank officers say that imports are tons better than exports. Because of this, if the greenback rises, inflation will rise. So as to have a negative effect on the entire united states.

Projects to draw imports

Bangladesh financial institution has now begun discouraging the import of luxury items due to the growing dollar and tightening of reserves. For this, the amount of coins deposit has been increased even as opening the debentures of automobiles and digital products. The critical financial institution said in a statement that the cash margin price had been rescheduled for the reason of establishing import bonds which will further consolidate the united states’ forex and debt management due to the global financial instability resulting from Corona’s have an effect on and the conflict scenario overseas. As a result, no less than seventy-five% coins margin has to be saved while opening a credit card for import of motor car (sedan automobile, SUV, and so on.), electronics used as a home appliances.

Dhaka bank MD Emranul Haque stated, “The important bank’s initiative will paintings to discourage the import of needless goods.” As an end result, no one will convey a car and leave it for months. Electric-powered merchandise produced within the united states of America may also be imported much less. This will lessen the strain on imports. The dollar marketplace will also be strong.

However, many have expressed skepticism approximately the effect of the easing on the greenback. Community bank MD Mosiul Haque Chowdhury wrote in a submission on Facebook, will the actual reason be executed on this notification? The fact, that despite the fact that the margin of the coin is a hundred percent, it can be stored only within the neighborhood forex. So will it be feasible to shop foreign money?

The greenback is strengthening after raising interest charges inside America. The dollar rose to its highest level in many years in global currencies on Monday. In the u.S., the demand for the dollar as a secure-haven investment in China’s lockdown has risen, in conjunction with the upward thrust in Treasury Yield (the fee at which the USA government borrows money over distinct durations).

Yesterday, the greenback rose to 104.19 in opposition to numerous global currencies, the best due to the fact that July 2002.

Related Posts

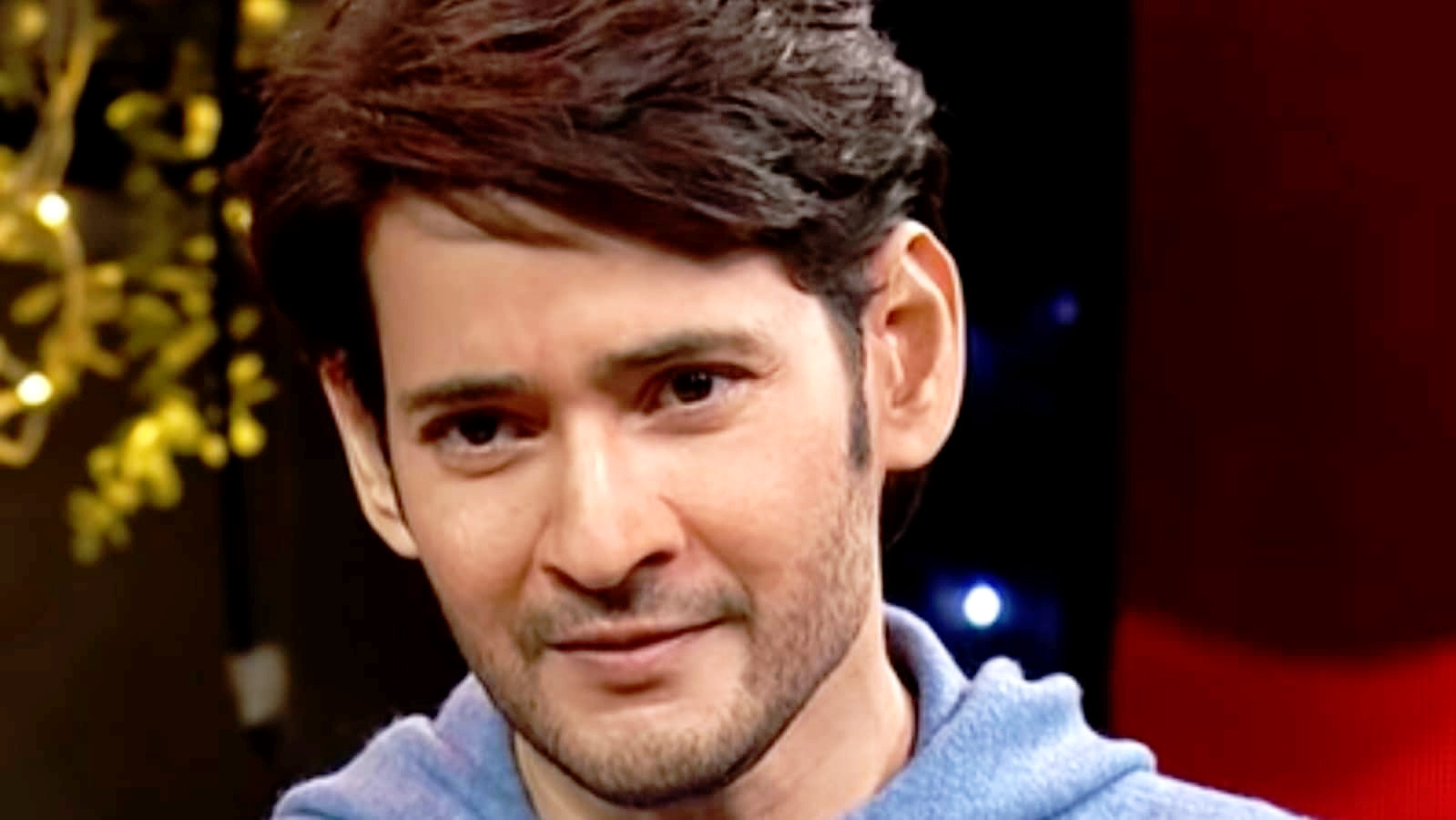

I don’t want to waste my time in Bollywood: Mahesh Babu

Queen Elizabeth’s jet fall bad weather